Definition Of Gst Malaysia

The proposed rates of tax will 5 and 10 or a specific rate.

Definition of gst malaysia. Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore. Malaysia replaced its sales and service tax regimes with the goods and services tax gst effective 1 april 2015. The goods and services tax gst is an abolished value added tax in malaysia gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer.

In other countries gst is known as the value added tax or vat. Types of gst in malaysia. The goods and services tax gst is a tax on goods and services sold domestically for consumption.

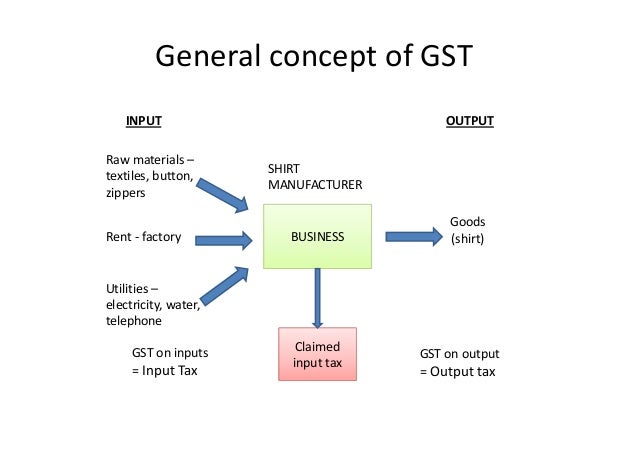

Manufactured goods exported would not be subject to sales tax. Gst tax is charged to the end consumer therefore gst normally does not become a cost to the company. Gst is levied and charged at a proposed rate of 6 percent on the value of supply.

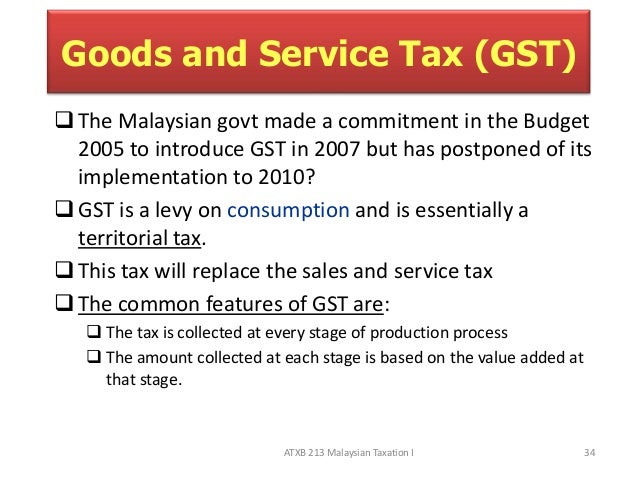

Gst exemptions apply to the provision of most financial services the supply of digital payment tokens the sale and lease of residential. Goods services tax gst will be implemented in malaysia on 1 april 2015 gst rate is fixed at 6. How to start gst.

Gst is an indirect tax expressed as a percentage currently 7 applied to the selling price of goods and services provided by gst registered business entities in singapore. The implementation of gst system that has two rates of gst 6 and 0 and provides for the zero rating of exported goods international services basic food items and many books as a broad based tax gst is a consumption tax applied at each stage of the supply chain. The following aspects of the gst system should be noted for all companies registering for the new system.

Read the top 10 gst questions. Sales and service tax sst in malaysia. Apa apa permohonan rayuan cbp.

The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018. The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia.

Attention please be informed that this portal will remain active until further notice. Goods are taxable unless specifically listed as being exempt from sales tax.