First Schedule Of Service Tax Regulations 2018

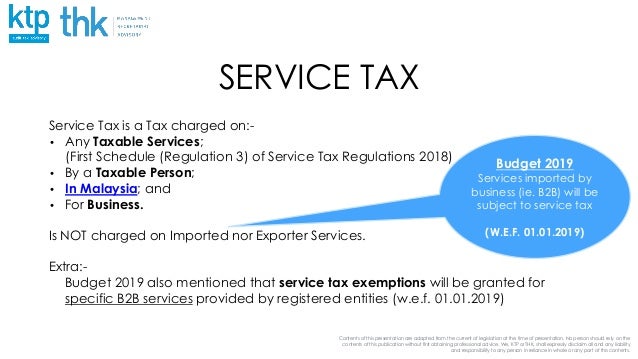

Any taxable person providing taxable services and exceed the respective thresholds are required to be registered.

First schedule of service tax regulations 2018. Section 7 of the act provides that service tax shall be charged and levied on any taxable services provided in malaysia by a registered person1 in carrying on his business. Rate of tax the service tax rate is fixed. The main amendments to the regulations are set out below.

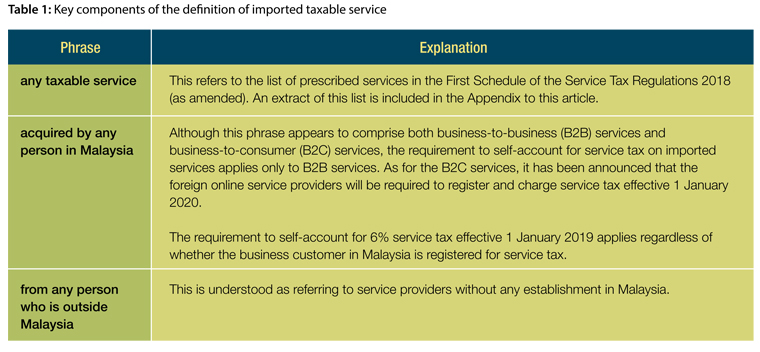

Act 52 of 2018 wef 01 01 2019 specially authorised customs officer means an officer of customs authorised under section 5 3 b to exercise the powers mentioned in that provision. Service tax regulations 2018. Intra group reliefintra group relief is applicable on the acquisition of imported taxable services under group g professional services first schedule of service tax regulations 2018 except for employment services and private agency if a company acquires the mentioned taxable services from a company within the same group of companies outside of malaysia such acquisition of service would.

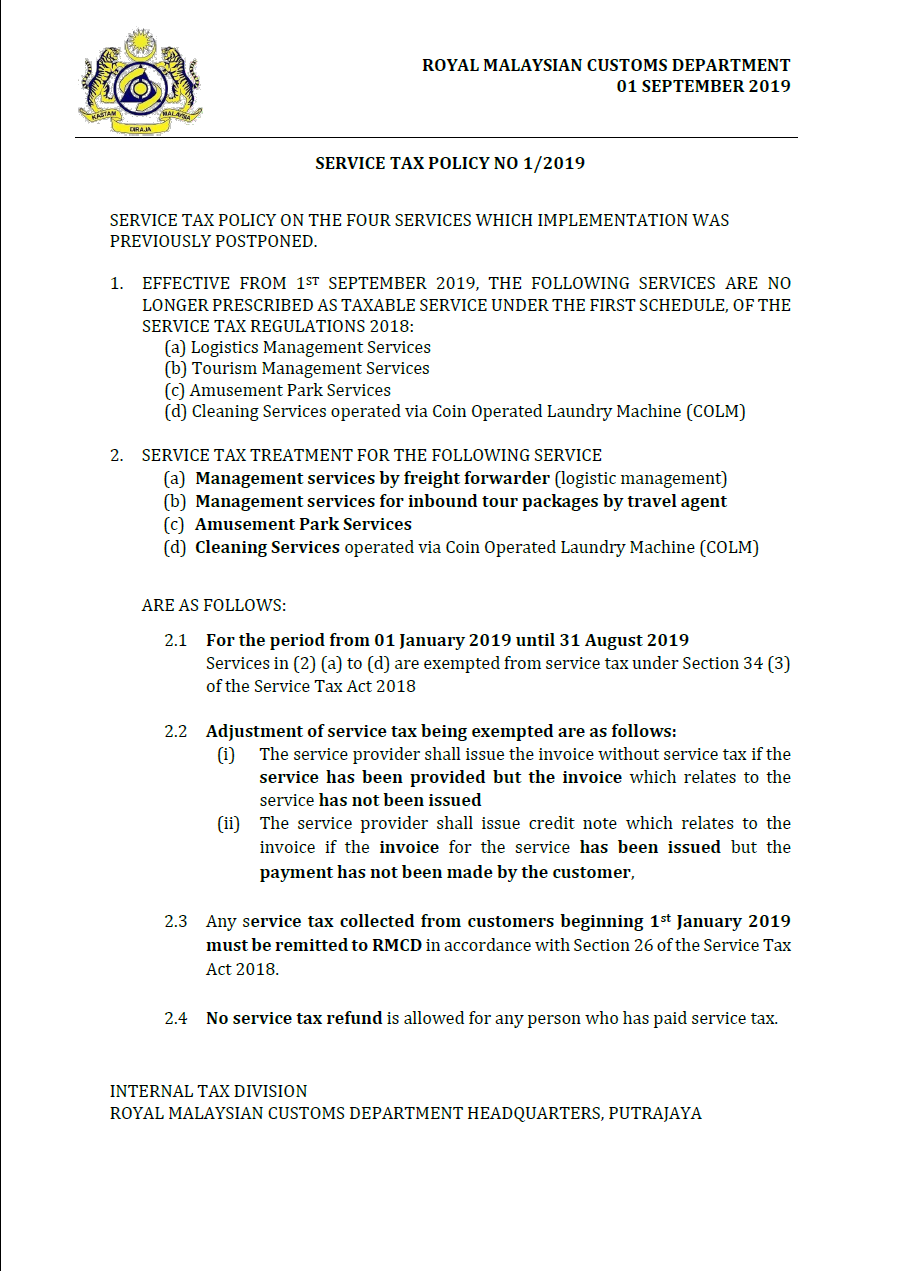

A bill i n t i t u l e d an act to amend the goods and services tax act chapter 117a of the 2005 revised edition and to make a consequential amendment to the income tax act chapter 134 of the 2014 revised edition. The regulations entered into force on 1 september 2019. A complete list of taxable persons and taxable services can be found in the first schedule to the service tax regulations 2018.

The first schedule to the service tax regulations 2018. Service tax is not imposed on imported and exported services. On 30 august 2019 the service tax amendment regulations 2019 the regulations providing certain amendments to the service tax regulations 2018 the principal regulations were gazetted.

Schedule a old module sign up. The first schedule of service tax regulations 2018. Read the first time on.

Schedule c3 c4 trader return payment. First schedule of the service tax amendments no 3 regulations 2018 1 clause 3a non applicability of intra group relief on imported taxable services this additional clause specifically excludes the applicability of intra group relief on imported taxable services for the taxable services acquired by businesses under group g of the. First schedule to the service tax regulations 2018 str states where a company provides any taxable service to a person outside the group of companies the same taxable service provided to any company outside or within the group of companies shall be a taxable service.

Paragraph 8 of the first schedule to the str is added to include.

(no%203)%20regulations%202018-page-002.jpg)